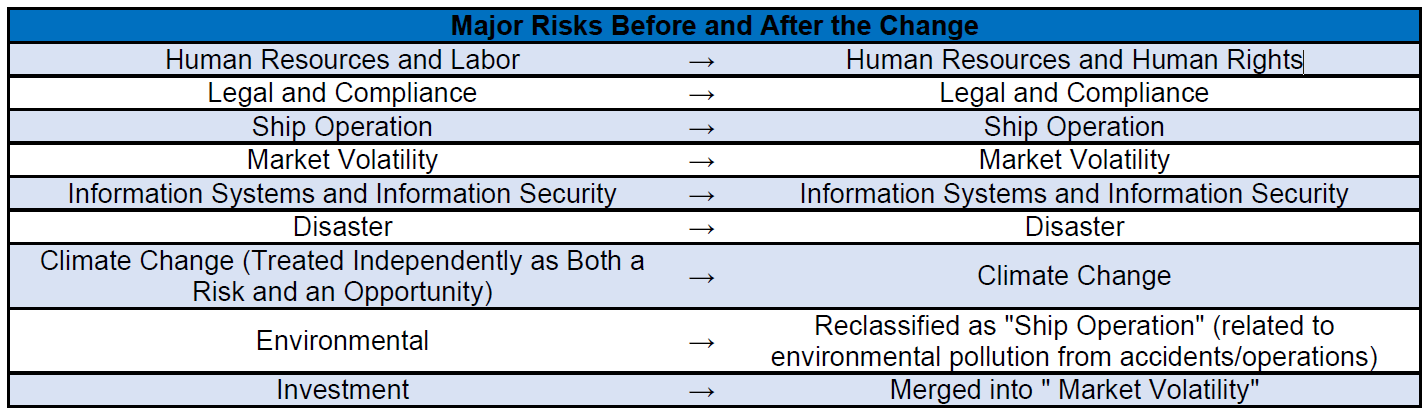

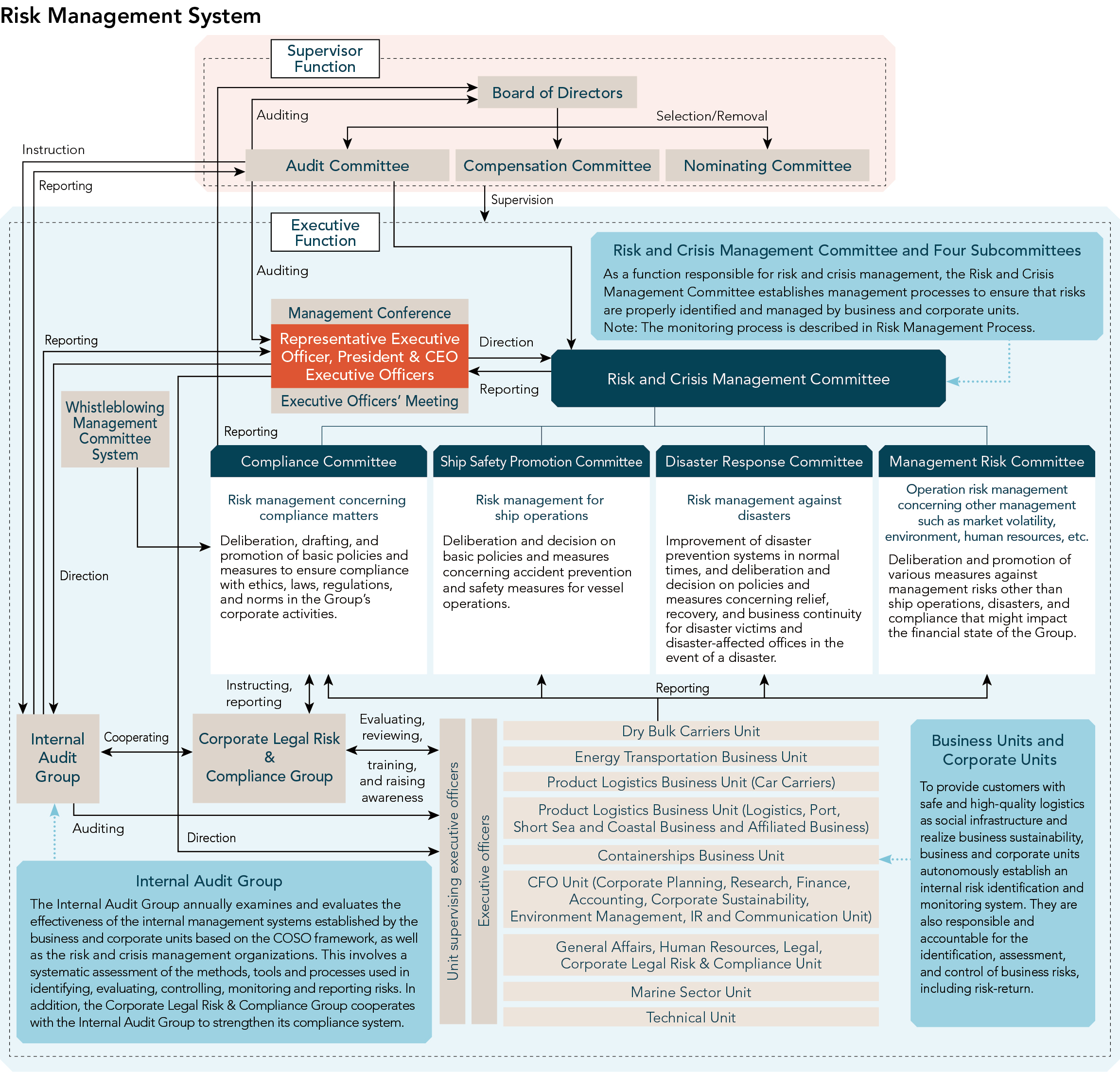

The Group operates businesses internationally. Its management of logistics businesses, including the maritime shipping business, involves various risks. To strengthen its risk management and manage risks more systematically, the Group has defined risks that could significantly impact its business continuity as major risks and reorganized its conventional eight major risks into seven risks. After this revision, the new major risks were divided into four categories, as the Group has done in the past. Specifically the categories are risks associated with vessel operations, disaster risks, compliance risks, and other management-related risks. Corresponding committees have been established.

In addition, the Risk and Crisis Management Committee was established to unify these four committees and to control and supervise overall risk management. The Representative Exective Officer, President & CEO serves as the chair of all these Committees, which meet quarterly. The four major risk management committees conduct regular and ongoing training activities to promote risk management. One example of such activities is the implementation of large-scale accident drills and participation in risk management workshops held by other companies. In addition, the Company designates each November as “Compliance Month” to reinforce awareness of the importance of compliance.

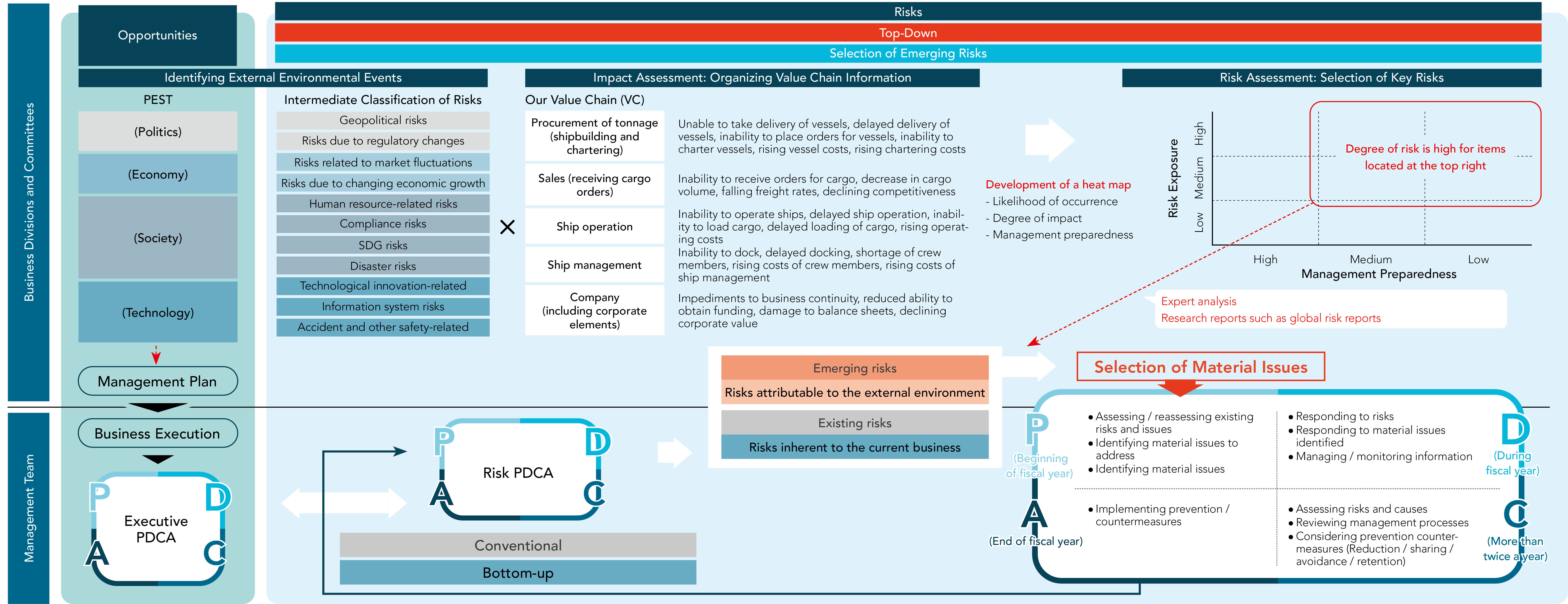

To ensure thorough risk management within the Group, we identify Groupwide risks and work to address them through the management and monitoring of information. At the end of each fiscal period, we reevaluate risks, specify and identify comprehensive risks, and determine serious risks to be addressed based on the effectiveness of the risk management system and our key risks. We then utilize a PDCA system to carry out regular reviews within each committee, perform reassessments, and implement measures accordingly. Under this PDCA structure, we respond to risks in a multilayered manner, combining a bottom-up approach where each committee reassesses, discovers, and identifies risks, with a top-down approach that assesses changing megatrends and other emerging risks that have not yet manifest but are of growing importance. Changing megatrends pose not only risks but also opportunities. Working from a PEST analysis* when formulating business strategies for the following fiscal year, we accurately apply our recognition of megatrends to business strategies while assessing and responding to the latest changes in risk trends. This enables us to address both risks and opportunities without omission.

More specifically, we envision risk scenarios that are the product of different combinations of PEST elements of the value chain in each of our businesses. Once the management team has organized the likelihood of occurrence, degree of impact, and state of readiness for each risk, we create a heat map. We then obtain external insight through expert analysis and research reports, while identifying issues to watch for, and select material issues in conjunction with risk identification based on a bottom-up approach.

Additionally, each business unit provides information on risk management throughout the PDCA cycle. Progress of risks and measures reported by each unit, as well as the serious issues and their countermeasures identified at the beginning of the fiscal year, are communicated internally daily through Board of Directors’ meetings and the Executive Officers’ Meeting.

Furthermore, we are strengthening our internal framework of monitoring and supporting risk management processes within the Board of Directors.

* PEST analysis is a framework for analyzing the impact on a company from identified threats in the external environment in four categories: politics, economy, society, and technology.

Ongoing Business Continuity Management (BCM) Formulation The “K” LINE Group has established a business continuity plan (BCP) and proceeded with BCM in preparation for impediments that could be caused by natural disasters or infectious diseases, including new strains of influenza. With respect for human life as our priority, we aim to ensure business continuity and thereby meet the responsibility that we must support society’s lifelines. To this end, we are transferring the management of operations to regional offices in Japan and overseas, storing backup data in remote locations, and utilizing teleworking. In preparation for an earthquake occurring directly beneath the Tokyo metropolitan area, we conduct regular evacuation drills and improve the BCM based on simulations of the scale and damage of such an earthquake. In these ways, we are making Companywide efforts to improve our disaster resilience.

In addition, “K” LINE has implemented a range of COVID-19 pandemic countermeasures. In the management of onshore operations, we expanded and enhanced teleworking and took thorough measures to prevent infection at offices. As for vessels and crew members, we monitored the health of crew members before they boarded vessels, issued an order requiring crew members to spend time in quarantine before boarding vessels, conducted PCR tests, and supplied anti-infection equipment and materials. In fiscal 2025, the Company’s business operations may continue to be affected by unexpected events, such as the emergence of variants of viruses or the discovery of new strains. However, by reviewing measures taken over the past five years and in accordance with a response manual for future pandemics caused by viruses, including the COVID-19 pandemic, we will establish capabilities for maintaining business continuity even during emergencies. We will then take measures suited to each business.

As rigorously ensuring the safety of vessel operations is one of our highest priorities, we are maintaining and heightening operational safety levels and crisis management capabilities. However, an unexpected accident, particularly one involving an oil spill or other major accidents leading to environmental pollution, could occur and have a negative impact on the Group’s financial position and operating results. Furthermore, piracy losses, operation in areas affected by political unrest or military conflict, and the increased risk to vessels from terrorism could cause major damage to the Group’s vessels and jeopardize the lives of crew members. This, in turn, could have a negative impact on the Group’s safe operation of vessels, voyage planning, management, and overall marine transportation business. To counter the aforementioned risks, the Ship Safety Promotion Committee, chaired by the president & CEO, meets periodically to conduct multifaceted investigations and initiatives for all matters related to the safety of vessel operations. Also, we have prepared an Emergency Response Manual, which sets out the accident response measures to be taken in the event of an emergency, and we continually improve our accident responses by holding regular drills for responses to large- scale accidents.

To encourage and reinforce an effective risk management culture throughout the organization, there are risk management sections in guidelines determined at each level of hierarchy, and we have created a personnel assessment system to ensure these standards are reflected. This assessment also has an impact on salary and promotions. Senior executives have a responsibility to implement risk management initiatives across the entire Company.

In addition, other risk management regulations and BCM information are posted on the top page of the intranet to educate employees, and we have a system to conduct lectures on risk management by experts anually for directors, including outside directors.

The “K” LINE Group is keenly aware of the importance of sustainability as a lifeline infrastructure that supports human life and the economy, and we formulated the “K” LINE Environmental Vision 2050 in response to risks and opportunities related to environmental protection and climate change.

We formulated the “K” LINE Environmental Vision 2050 in March 2015 and we set forth specific milestones to reach by 2019, the 100th anniversary of our founding, and we have achieved many of them.

Additionally, as the global movement toward net-zero GHG emissions by 2050 accelerates, we revised the goals set out in our 2050 vision in November 2021 and will take on the challenge of further increasing our goal to achieve net-zero GHG emissions by 2050.

Please refer to the following for scenario analysis of climate change.

https://www.kline.co.jp/en/sustainability/environment/management/main/010/teaserItems2/018/linkList/0/link/2111vision%20minaoshi_EN.pdf

Based on the above business plans and strategies, we are implementing various environmental preservation initiatives, including the introduction of the Seawing automated kite system (wind propulsion), which uses natural energy.

Please refer to the following for more information about the Group’s environmental activities.

Environment

Description of the risks, mitigation actions, likelihood of impact on the organization, magnitude of the potential business impact and the prioritization of risks identified decided by the aforesaid elements are described in the table.

|

Risks |

(i) Human Resources and Human Rights |

|

Degree of Impact |

Extremely Large |

|

Explanation of Risks and Business Background |

|

|

As a corporate group that operates around the world, the Group is aware of the impact its business activities have on local and international communities and it believes that the implementation of business activities based on this awareness is one of the key aspects of social responsibility. The global community’s expectations of business enterprises in terms of respect for the human rights of all stakeholders in their business activities are increasing year by year. In these circumstances, a failure to adequately address human rights issues within the Group or its supply chain could negatively impact the Group’s business activities. Additionally, a shortage of the talent the Company requires could decrease its competitiveness in the industry or have a serious negative impact on its business continuity. |

|

|

Impact on Business |

|

|

In the event of a human rights issue, the Group’s sales activities, financial position and operating results could be negatively impacted due to a loss of public trust or damage to its brand image. In addition, a lack of necessary personnel constrains business activities. It could have a significant negative impact on the Group’s operating results. |

|

|

Action to Mitigate Risk |

|

|

In the Charter of Conduct for the “K” Line Group companies, the behavior standard for the entire Group, the Group declares that it will respect the human rights of all stakeholders involved in its business activities. In the “K” Line Group Basic Policy on Human Rights, which is a more specific version of the standards than the Charter, the Group stipulates that it will respect and comply with international norms and laws and regulations related to human rights , and that it will conduct human rights due diligence, that is, it will understand the actual or potential adverse impacts on human rights that may arise in relation to its business activities and prevent or mitigate them before they occur. To identify the human rights issues that should be addressed as a priority in the Group’s business activities in accordance with this policy, we conduct hearings with Group companies in Japan and abroad to identify issues that require stronger initiatives at each individual company and we implement action plans for improvement based on the results. Moreover, we aim to establish a PDCA cycle through which we will implement initiatives aimed at respecting the human rights of all stakeholders in the business activities of the Group, including its supply chain. To increase the Company’s competitiveness in its industry and achieve stable business continuity, the Company will develop its personnel from the perspective of securing personnel who will be leaders in innovation and the continued growth of business and who will be capable of responding flexibly to changing business conditions. |

|

|

Risks |

(ii)Legal and Compliance |

|

Degree of Impact |

Extremely Large |

|

Explanation of Risks and Business Background |

|

|

As a corporate group that operates around the world, the Group is aware of the impact its business activities have on local and international communities and it believes that implementing these business activities with an even higher awareness of compliance is one of the key aspects of social responsibility. Any act of an officer or employee of the Group that violates laws, regulations, corporate ethics or similar rules could have an enormous negative impact on its business activities. As the movement toward a sustainable society gains momentum, it is now essential not only for the Company alone but for the entire supply chain to cooperate in the establishment of a sustainable society. |

|

|

Impact on Business |

|

|

Compliance-related risks change depending on social circumstances and public awareness and cannot be completely avoided. In the event of a compliance-related issue, the Group’s sales activities, financial position and operating results could be negatively impacted due to a loss of public trust in the Group or damage to its brand image or to actions taken in connection with the compliance issue. |

|

|

Action to Mitigate Risk |

|

|

We established the “K” LINE Group’s Charter of Conduct, and under this Group charter we adopt compliance with laws, regulations, and corporate ethics as principles for action for the “K” LINE Group. Additionally, we established the “K” LINE Group Global Compliance Policy (the Global Policy) as more specific guidelines, with which all officers and employees must comply. The Company convenes the Compliance Committee four time a year as an opportunity to deliberate policies for ensuring compliance at “K” LINE and its Group companies and actions to be taken to address compliance violations. We set every November as “Compliance Month” when we distribute the Representative Exective Officer, President & CEO message to officers and employees of “K” LINE and its Group companies to remind them of the importance of compliance. We also hold mandatory compliance e-learning training and compliance seminars featuring lecturers invited from outside the Company. As part of our stratified personnel training system, we conduct compliance training and we offer various other programs to systematically foster a compliance culture. We are working to build relationships of mutual trust and cooperation with our business partners as an indispensable partner in providing services that our customers trust. In addition, we formulated “K” Line Group Companies CSR Guidelines for Supply Chain to promote CSR across the entire supply chain and work together with our customers to realize a sustainable society. |

|

|

Risks |

(iii)Ship Operation |

|

Degree of Impact |

Extremely Large |

|

Explanation of Risks and Business Background |

|

|

The Group has positioned safety in all ship operations and environmental conservation as its top priorities and has maintained and strengthened its safe operation standards as well as a crisis management system. An unexpected accident that damages a ship, its cargo, crew or cargo handling personnel, and in particular a major accident that leads to an oil spill or other environmental pollution, could have an enormous adverse impact on business activities. Furthermore, piracy losses, operating in areas affected by political unrest or military conflict, the increased risk to vessels from terrorism, and Cyber risk could cause major damage to the Group’s vessels and jeopardize lives of the crews. This in turn could have a negative impact on the Group’s safe operation of vessels, voyage planning and management and overall marine transportation business. |

|

|

Impact on Business |

|

|

An unexpected accident, especially an oil spill or other serious accident resulting in environmental pollution could seriously impact the Group's financial position and operating results. The Group’s sales activities could be negatively impacted due to a loss of public trust in the Group, damage to its brand image or actions taken in connection with the loss of public trust or damage to its brand image. |

|

|

Action to Mitigate Risk |

|

|

The Group has positioned safety in all ship operations as its top priority and has maintained and strengthened its safe operation standards as well as a crisis management system. In pursuit of safety in navigation and cargo operations, the Ship Safety Promotion Committee, chaired by the Representative Exective Officer, President & CEO, meets periodically to discuss all matters related to the safety of vessel operations including accident prevention and response to terrorism from all perspectives, including equipment and operation. Accordingly, the Group implements many different measures including training and guidance. Furthermore, in our Emergency Response Manual we have set out the actions we must take in the event of emergency, and accident response is continually improved by regularly holding accident response drills. In addition, the Group takes out appropriate insurance so that it is prepared to implement sufficient responses action even if fails to avert an accident despite its best possible efforts. The Group is aware that its business activities impact the global environment. To minimize this impact, the Group has formulated the “K” Line Group’s Environmental Charter to ensure that it implements environmental initiatives. In addition, the Corporate Sustainability Management Committee chaired by the Representative Exective Officer, President & CEO has been established to discuss and formulate a system for managing sustainability. |

|

|

Risks |

(iv)Market Volatility Risk |

|

Degree of Impact |

Large |

|

Explanation of Risks and Business Background |

|

|

The Group’s businesses are closely linked to global economic trends and susceptible to fluctuations in various economic factors. In particular, a high proportion of the Group’s business is conducted in US dollars. The appreciation of the yen involves the risk of a decrease in income denominated in yen. The Group also uses borrowings to invest in ships and procure operating capital. A rise in interest rates could be a factor causing income to decline. The cost of fuel is a significant component of the Group’s ship operating costs. The fluctuation of crude oil prices can impact the Group’s income. These market risks change depending on various factors including global economic trends and geopolitical risks. The vessel investment plan for the expansion of business in the future may not proceed as planned due to the deterioration of shipping market conditions or the unexpected introduction of public regulations. A delay or cancellation of the plan or failure to capture expected demand after the completion of a new vessel could negatively impact income. It may become necessary for the Group to sell some of its existing vessels or terminate charter contracts for chartered vessels early if market conditions deteriorate or the vessels become obsolete due to technological innovation. These risks may cause the Group to incur losses. The deterioration of market conditions or profitability may cause the Group to record an impairment loss regarding its assets, such as vessels. The shipping business is structurally susceptible to international treaties and the regulations and trade policies of different countries and regions. The introduction of new regulations or the revision of existing ones may increase business costs and restrict business activities. There is the risk that an increase in uncertainty would reduce predictability. In the international shipping market, competition is intensifying. Changes in trade patterns, the decline in transportation costs and the decline in market share could negatively impact income. Any business partner’s failure to perform a contract due to the deterioration of its financial results may cause the Group to incur losses. |

|

|

Impact on Business |

|

|

These changes in economic activity may have a significant negative impact on the Group’s financial position and operating results. The sharp appreciation of the yen against the US dollar may decrease the value of the Group’s business sales in US dollars converted to the Japanese yen. This may consequently decrease income considerably. The increase of interest rates may increase the Group’s financing costs. This may not only make it difficult to implement the investment plan but also deteriorate the profitability of its existing businesses. The fluctuation of fuel oil prices may directly increase the Group’s operating costs and be major factor lowering its profitability. The increase in fuel oil prices following an increase in crude oil prices may not only reduce the Group’s income in the short term but also make it necessary to revise the medium- and long-term business plan. The delay or cancellation of the investment plan may lead to opportunity loss and there is the risk that the Group may fail to recover investments it has made. The sale of vessels or the early termination of charter contracts amid the deterioration of market conditions may not only result in the Group incurring a loss but also reduce the Group’s transportation capacity in the future and result in the loss of business opportunities. The impairment of the Group’s assets may negatively impact its financial position and operating results. The Group may incur significant expenses and have to invest capital, change operations or take other actions to comply with revised regulations. This may put downward pressure on the Group’s income. Delays in complying with revised regulations and in incorporating the revised regulations into the business plan due to reduced predictability may cause the Group’s business activities to be restricted, cause the Group to be fined or result in other serious situations. Intensifying competition in the international shipping market may lower transportation prices and decrease profitability. It may also change trade patterns to reduce the Group’s market share. It may thus have some negative impact on its position in the industry and on its operating results. A business partner being unable to perform a contract may cause the Group to incur losses and lead to the loss of future business opportunities due to lost trade relationships. |

|

|

Action to Mitigate Risk |

|

|

The Group implements various measures to manage these risks regarding changes in economic activity. To mitigate the impacts of the fluctuation of foreign exchange rates, the Group enters into foreign exchange forward contracts and converts a portion of its expenses into US dollars. To address the risk of the fluctuation of interest rates, the Group borrows at fixed interest rates and uses fixed interest rate swaps to stabilize fund procurement expenses. To control fuel costs, the Group enters into fuel oil futures contracts to hedge prices. The Group carefully formulates investment plans based on market research and demand forecasts and controls the estimated maximum losses within its consolidated shareholders’ equity to ensure both stability and growth potential. To prepare for a deterioration of market conditions, the Group is structured so that it can constantly monitoring market conditions and make timely decisions on the sale of vessels and the cancellation of charter contracts. The Group also estimates the value of its assets regularly to detect impairment risks at an early stage. The Group has made preparation so that it can collect the most up to date information about international treaties and the revision of the regulations and trade policies of different countries and regions and quickly achieve compliance with them. To mitigate risks regarding business partners’ failure to perform contracts, the Group always monitors the credit status of its partners and rigidly manages credit. |

|

|

Risks |

(v)Information Systems and Information Security |

|

Degree of Impact |

Large |

|

Explanation of Risks and Business Background |

|

|

The Group takes measures to ensure and improve information security in order to provide safe and secure marine transportation and logistics services as a logistics infrastructure supporting global economic activities. Cyber-attacks have become extremely diverse in recent years, and they may have an enormous adverse impact on the Group's business activities if information leaks occur due to the unauthorized access of the Group's systems or there are malware-caused system outages. |

|

|

Impact on Business |

|

|

When information is leaked due to unauthorized access or system shutdowns or other trouble occurs due to a computer virus attack, the sales activities, financial condition and operating results of the Group could be severely affected. |

|

|

Action to Mitigate Risk |

|

|

“K” LINE continues to reinforce its cybersecurity. To date, we have strengthened the security of our communications networks and endpoints, such as PCs and servers, and rolled out security monitoring systems using the latest technology. Furthermore, by reviewing the configuration of the global authentication infrastructure and increasing the level of multifactor and account management authentication, we have strengthened IT governance, improved levels of authentication, and bolstered measures against malware and information leaks on a Groupwide basis, thereby establishing a system that can respond quickly and accurately to cyber incidents. In recent years, data has been increasingly used to improve safety and quality, and internet connections are used to share vessel navigation data from ship to shore. It has also become necessary to upgrade ICT equipment and networks on ships because of improvements in satellite data transmission capacity. With a view to increased potential cyber risks as ship to-shore internet connectivity evolves, ship management companies that belong to the “K” LINE Group have obtained Cybersecurity Management System (CSMS) certifications from Nippon Kaiji Kyokai (ClassNK) since 2020. We continue efforts to enhance our ability to respond to cyber risks on ships. "Safety" is the core competence of "K" LINE Group's maritime transport business. We will provide safer and more optimal transportation services by strengthening our response to cyber risks. In addition to technological countermeasures, we are training employees on cybersecurity to foster a security-first mindset, and we are advancing DX based on a secure, safe, and robust IT infrastructure. |

|

|

Risks |

(vi)Disaster |

|

Degree of Impact |

Large |

|

Explanation of Risks and Business Background |

|

|

Maintenances of business operations in the event of a natural disaster or pandemic in the Group’s duty as the Group provides pivotal role for society, and it is a critical aspect of the justification for the Group’s existence. If a major earthquake were to occur at the heart of the Tokyo metropolitan area, many buildings, transportation systems and lifelines are expected to suffer from major damages. Furthermore, if infectious diseases, equivalent to the Act on Special Measures for Pandemic Influenza and New Infectious Diseases Preparedness and Response, were to arise and cause a global pandemic, it could seriously harm the health of many people. Reputational damage could also accompany such natural disasters and secondary disasters. |

|

|

Impact on Business |

|

|

When a natural disaster has occurred or infections covered by the Act on Special Measures for Pandemic Influenza, etc. have occurred and developed into a pandemic, it could have a impact on the Group's sales activities, financial position and operating results. |

|

|

Action to Mitigate Risk |

|

|

The Group has established a business continuity management (BCM) system to handle these disasters. In the event of a disaster, the Group is prepared to continue its business operations to the greatest extent possible by implementing or adapting its plans. The Group has reviewed the responses implemented to handle the COVID-19 pandemic to complete an operational plan to prepare for future pandemics. The Group regularly carries out drills and other activities focusing on hypothetical disasters and similar situations at the head office and outside the company and addresses issues identified during these drills to continuously revise its BCM system and increase its effectiveness. |

|

|

Risks |

(vii)Climate Change |

|

Degree of Impact |

Large |

|

Explanation of Risks and Business Background |

|

|

Climate change, for example, global warming, involves the risk that weather and oceanic phenomena will become more violent and disrupt the safety of navigation and cargo operations. The trend towards decarbonization as a measure to address climate change may significantly impact the business environment surrounding the Group, as its business requires an enormous amount of fuel oil and involves the transportation of various fossil energy resources as principal cargo. This impact may take the form of public regulations and equivalent measures that increase costs and structurally change transportation demand. There is the additional risk that the Group implementing insufficient measures to address climate change may decrease its competitiveness. |

|

|

Impact on Business |

|

|

If the impact of climate change becomes more apparent in the future, it may be necessary for the Group to change transportation routes and incur higher operation costs. This may increase risks of damaging cargo on board or the vessels themselves and there is the risk of related litigation. Failure to follow the trend towards decarbonization as a measure to address climate change may have a serious negative impact on the Group's business activities, financial position and operating results. |

|

|

Action to Mitigate Risk |

|

|

The Group has positioned safety in all ship operations as its top priority and it endeavors to maintain and strengthen its safe operation standards and its crisis management system. Using its proprietary weather and oceanic conditions forecasting system, the Group selects optimal routes to reduce the risk that a ship may enter a high sea state area, pitch and damage cargo. The Group's measures to address matters that may impact its business include the introduction of an application that forecasts the occurrence of specific roll motions which are a cause of cargo shifting. In the "K" LINE Environmental Vision 2050, the Group has declared that it will aim to achieve net zero greenhouse gas (GHG) emissions in 2050. In its long-term vision, the Group is committed to its own smooth transition to other forms of energy, and also society's similar transition, and to activities aimed at realizing a low-carbon and carbon-free society. In the Medium-Term Management Plan, the Group envisions the achievement of growth through investment in the environment in line with a growth strategy that views the transition to a low-carbon or decarbonized society as an opportunity. In addition, the Group has reviewed the scenario analysis method recommended by the Task Force on Climate-related Financial Disclosures (TCFD) and estimated the financial impact of climate change risks and opportunities in four categories, namely governance, strategy, risk management and metrics and targets to expand the information it discloses about these risks and opportunities. |

|

We carry out sensitivity analysis and stress test twice a year in budgeting and monitoring monthly.

Key variables are exchange rates, interest rate, fuel oil price as well as market indices such as BDI (Baltic Dry Index) for dry bulkers, and WS(World Scale) for oil tankers.

These variables are major variation factors to our operating revenue and ordinary income.

Also we perform market valuation test for our owned vessels as our core assets of our business by using quotes from VesselsValue.com and other professional sources, such as shipping brokers.

The Group defines emerging risks as risks that may hinder the execution of its business strategy and that have not yet manifest but are of growing importance.

|

Risks |

(i) Impact of Changes in Geopolitical Conditions on Cargo Movement, Shipbuilding and Maintenance |

|

Explanation of Risks and Businessss Background |

|

|

Geopolitical factors are increasingly uncertain, especially the U.S.-China relationship, and there is the risk that they will negatively impact the Group's operating results. Global changes in supply chains and the trend towards local production for local consumption may prompt the Group's customers to revise their business models, damaging the balance between transportation demand and supply capacity and affecting market conditions and pricing. These factors may have a major negative impact on the Group's businesses. In addition, in view of the quantity of ships being built in China and the Group's dependence on China in terms of maintenance and docking, the deterioration of the U.S.-China relationship may cause problems related to shipbuilding and maintenance and hamper continuous vessel operations. The Group still has a backlog of orders for new ships to be built in China and needs to keep a close eye on this risk. |

|

|

Impact on Business |

|

|

The Group's businesses depend heavily on marine transportation, and cargo movement trends significantly impact the Group's operating results. The Group's vessels are required to be drydocked every five years. Chinese docks are used by many ships from many different countries, and if the Group's ability to use these docks is hampered, this will have a significant negative impact on the Group's vessel operations, business activities and operating results. China builds nearly 50% of the world's ships and this percentage has been increasing in recent years. The disruption of shipbuilding in China may enormously impact the global supply of ships and the Group's business activities and operating results. |

|

|

Action to Mitigate Risk |

|

|

While centering on deepening its partnerships with major customers, the Group creates opportunities for growth by building closer relationships with its diverse customers, clarifying its roles according to the characteristics of the specific business and appropriately managing its business portfolio. Additionally, the Group quickly identifies changes in its customers' strategies by developing and increasing the sophistication of its sales structure, for instance by increasing the number of sales and operations personnel and training environmental sales staff, and flexibly adapts to changing supply chains and business models. The Group manages orders for new ships on a groupwide scale, quantifying risks and considering the diversification the shipyards it places orders with, and it consults with experts to minimize risks. The Group manages and diversifies the docks it uses for vessel maintenance and their locations Group-wide and discusses issues to formulate best practices. |

|

|

Risks |

(ii) Emerging Technological Innovation that Threatens The Maritime Shipping Industry |

|

Explanation of Risks and Business Background |

|

|

It is believed that technological innovations including three-dimensional (3D) printers, augmented and virtual reality (AR and VR) technologies and automation will lower the barriers to entry into the maritime shipping market in the future. The expansion of the materials that can be handled using 3D printers and the advancement of molding methods are increasing the possibilities for their application in the mass production of final products. The combined utilization of automated and autonomous port handling operations and vessel operations based on digitalization and the use of an industrial metaverse will help address the labor shortage and increase operational efficiency. While these technological innovations help reduce the costs of the maritime shipping business, they may also ease the barriers to entry that organizations from other sectors would encounter. Regarding the transportation of consumer goods and finished products, local production for local consumption may increase due to changes in manufacturing structures following technological innovation. In the area of demand for container transportation and finished vehicle transportation in particular, this may structurally change the business environment. It is necessary to pay close attention to technology trends more broadly than before. |

|

|

Impact on Business |

|

|

Technological innovations including 3D printers, AR and VR technologies and automation may lower the barriers to entering the industry. This may make it easier for new competitors to enter the market and it may intensify price competition. That may lead to the emergence of new competitors who may capture market share from existing companies. In addition, technological innovations may increase the efficiency of supply chains and reduce costs. The widespread use of new technologies may cause existing facilities and expertise to become obsolete, requiring new investments. A structural change in the business environment may have a significant negative impact on the Group's sales activities and operating results. |

|

|

Action to Mitigate Risk |

|

|

The Group needs to consider training personnel to handle new technologies and forming strategic alliances with companies that possess the latest technologies, so that it is always up to date on the latest technology trends, not just in the maritime shipping business, and so that it is able to establish a structure for assessing the impact that technologies may have on its businesses. To do this, the Group identifies and organizes the issues that individual business divisions face and systematically organizes and selects priority issues to construct a risk intelligence cycle and establish a system for the continuous monitoring of the status of risks, leveraging the expertise of people outside the Group. |

|

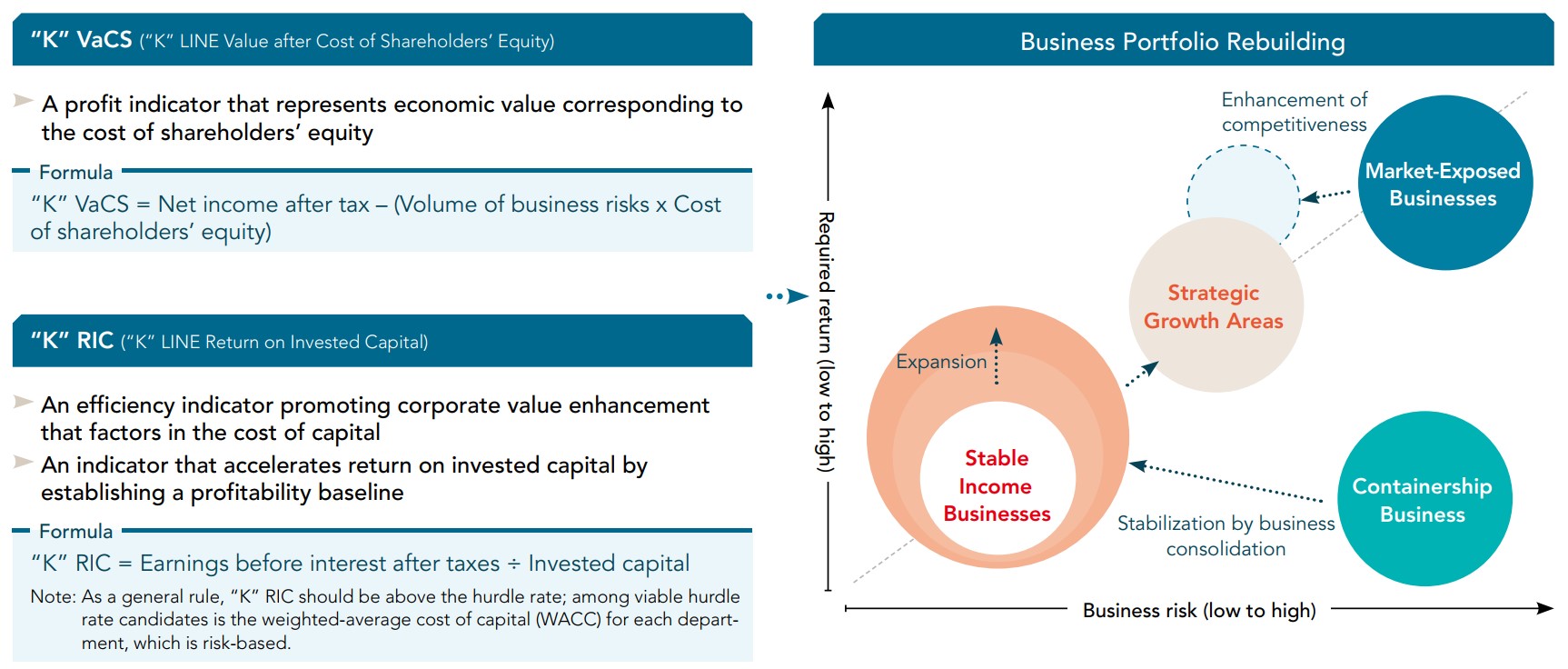

Aiming to realize business portfolio rebuilding through maintaining and expanding stable income businesses, strengthening the competitiveness of market-exposed businesses, and expanding investments in strategic growth areas, we have introduced “Advanced Business Management”,which focuses on the following two points.

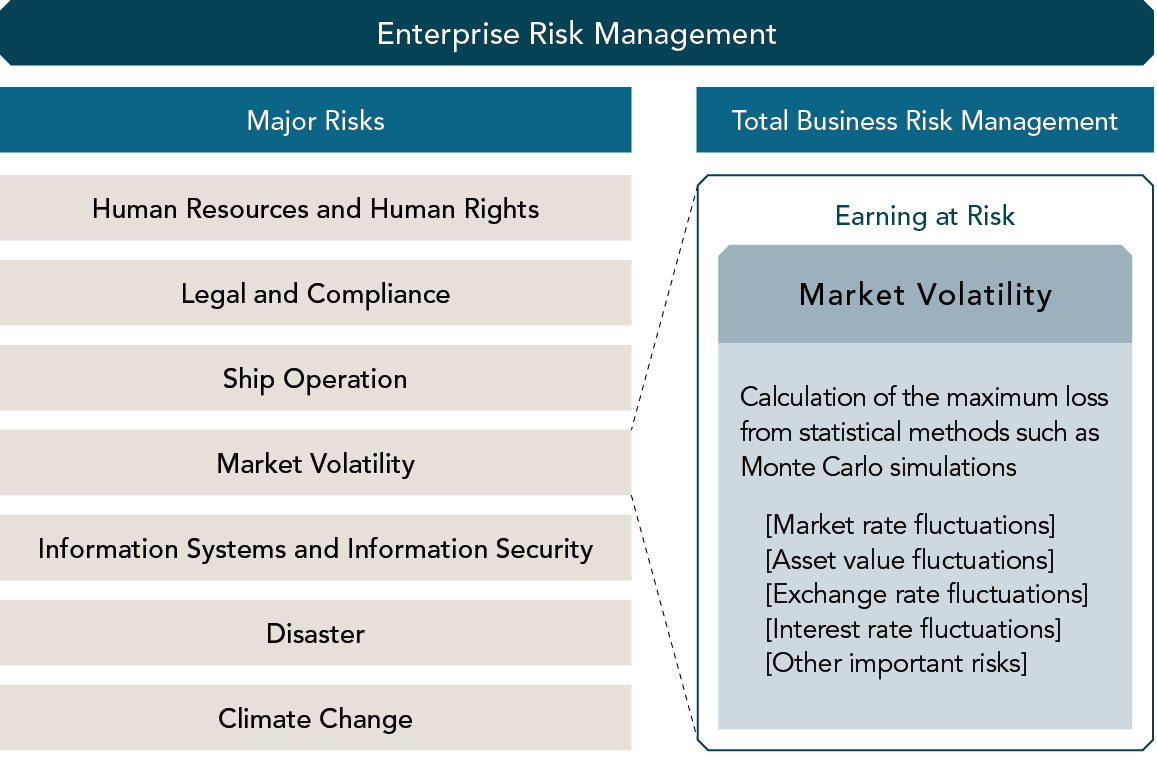

We control the estimated maximum losses within consolidated shareholders’ equity and pursue both stability and growth by maintaining the proper size of investments. We measure business risk as the estimated maximum loss for each business utilizing statistical methods such as Monte Carlo simulations.

The risks facing the Company’s businesses are varied and diverse. Total business risk management targets any “risk of loss” that would lead to capital impairment. The risks not subject to total business risk management shall be controlled by each business unit, and enterprise risk management shall be managed by the Risk and Crisis Management Committee and its subordinate organizations.

We have introduced investment and business performance indicators that emphasize business risk-return (“K” VaCS / “K” RIC) and realize an optimal business portfolio by utilizing them.