Since we set 2030 interim milestones in “K” LINE Environmental Vision 2050, we have been trying to minimize all kinds of environmental burdens by our business activities. In that vision, we set some interim milestones as follows;

- CO2 emission efficiency improvement by 50% over 2008 (beyond IMO target of 40%)

- Pursuance of transporting and supplying new energy for a low-carbon society

There are four key elements in the Climate Transition Finance Handbook issued by ICMA.

|

Four key elements |

“K”LINE’s transition strategy |

|

1.Issuer’s climate transition strategy and governance |

- CO2 emission efficiency improvement by 50% over 2008 (beyond IMO target of 40%) - Pursuance of transporting and supplying new energy for a low-carbon society →The LNG-fueled car carrier with this loan is one of the concrete action plans for achieving these milestones |

|

2.Business model environmental materiality |

- IMO adopted an ambitious GHG reduction strategy with a vision to decarbonize. - Accelerating the initiatives to achieve our decarbonization goals in line with IMO’s strategy, we meet the requirement of low-carbon shipping services from customers and stakeholders.

-We select material issues based on the results of scenario analysis, recommended by TCFD. |

|

3.Climate transition strategy to be ‘science-based’ including targets and pathways |

|

|

4.Implementation transparency |

|

- 拡大

- Next-generation Environmentally

Friendly Car Carrier Fueled by LNG

”CENTURY HIGHWAY GREEN”

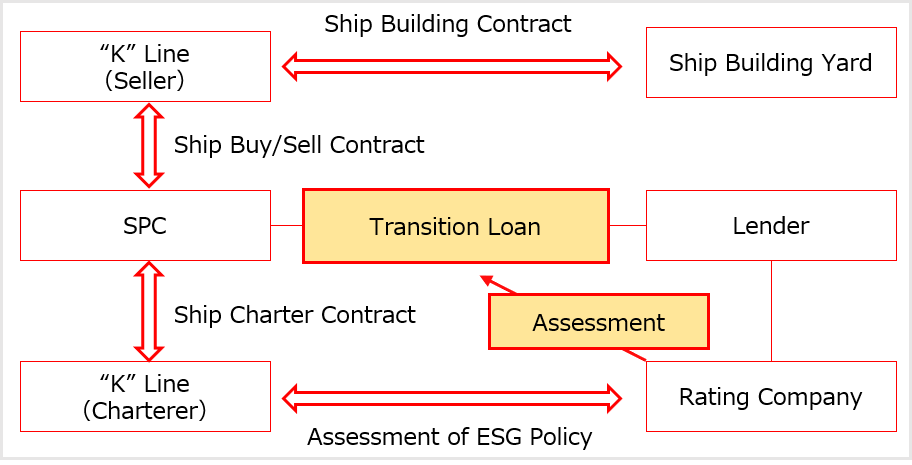

“K” LINE is pleased to announce that we have arranged an operating lease for the Next-Generation Environmentally-Friendly LNG-fueled Car Carrier through Climate Transition Loan with Mizuho

Bank Ltd. (MHBK) and Sumitomo Mitsui Trust Bank Ltd. (SMTB).

This loan is recognized as the very first Climate Transition Finance in Japan.

The loan was evaluated by Japan Credit Rating Agency, Ltd.(JCR) in line with the Climate Transition Finance Handbook published by the International Capital Markets Association(ICMA) and it acquired the highest recognition, Green1(T), as an overall evaluation.

The concept of Climate Transition Finance is to accelerate the efficient flow of financing to the companies, which address climate change risk as material issues for its core business activities and to move beyond conventional business procedures to achieve its GHG emission reduction target to contribute to the global goals for decarbonization.

∎ Use of Proceeds

- The loan was applied to purchase of the LNG-fueled car carrier, one of the concrete action plans for the environmental strategy

- The vessel is expected to be about 45% more energy-efficient (EEDI basis), reduce sulfur oxides by about 100%, nitrogen oxides by about 80 to 90% with Exhaust Gas Recirculation (EGR), compared to vessels using conventional heavy fuel oil.

- The project is officially supported by the Ministry of the Environment and Ministry of Land, Infrastructure, Transport and Tourism as “a model business using alternative fuels to reduce ship CO2 emissions”

∎ Project Evaluation and Selection Process

- The project was evaluated and selected by relevant divisions to see conformance to eligible criteria, and was approved by board members

∎ Management of Proceed

- The proceeds will be managed by cash flows based on the contracts among relevant parties

- All the proceeds are tied to this specific project

- The proceeds are tracked and managed through our internal accounting system

∎ Reporting

- All the funds procured from the loan is applied to the purchase of the LNG-fueled vessel

- GHG (CO2) emissions from the vessel will be disclosed annually to the lenders

- Our KPIs on environmental strategy will be updated on our website accordingly

|

∎ Three SPTs

In this transition linked loan, three SPTs are set as follows;

- SPT1: Total yearly GHG emissions throughout all loan term

(Target: 50% Down at 2050 comparing 2008) - SPT2: Yearly CO2 emissions per ton-mile throughout all loan term

(Target: 50% Down at 2030 comparing 2008) - SPT3: “A-” rating or higher by CDP rating

All above SPTs are connected with a matrix table of loan interest and this promotes our transition strategy.

|