“K” LINE is developing and strengthening its corporate governance and risk management structures to fulfill its social responsibility and its commitment to its stakeholders including shareholders, and to achieve sustainable growth. While thoroughly enforcing its corporate ethics across the entire Group, “K” LINE will continue developing an organic and effective governance framework, strengthening its earning and financial structures, and enhancing its corporate value.

Under the “Corporate Governance Code” formulated by Tokyo Stock Exchange, Inc., we are enhancing our corporate governance structure and formulating Kawasaki Kisen Kaisha, Ltd. CORPORATE GOVERNANCE GUIDELINES to clarify our approach and management policy.

In line of our Corporate Governance Guidelines, the Criteria for Independence of outside directors is prescribed as below:

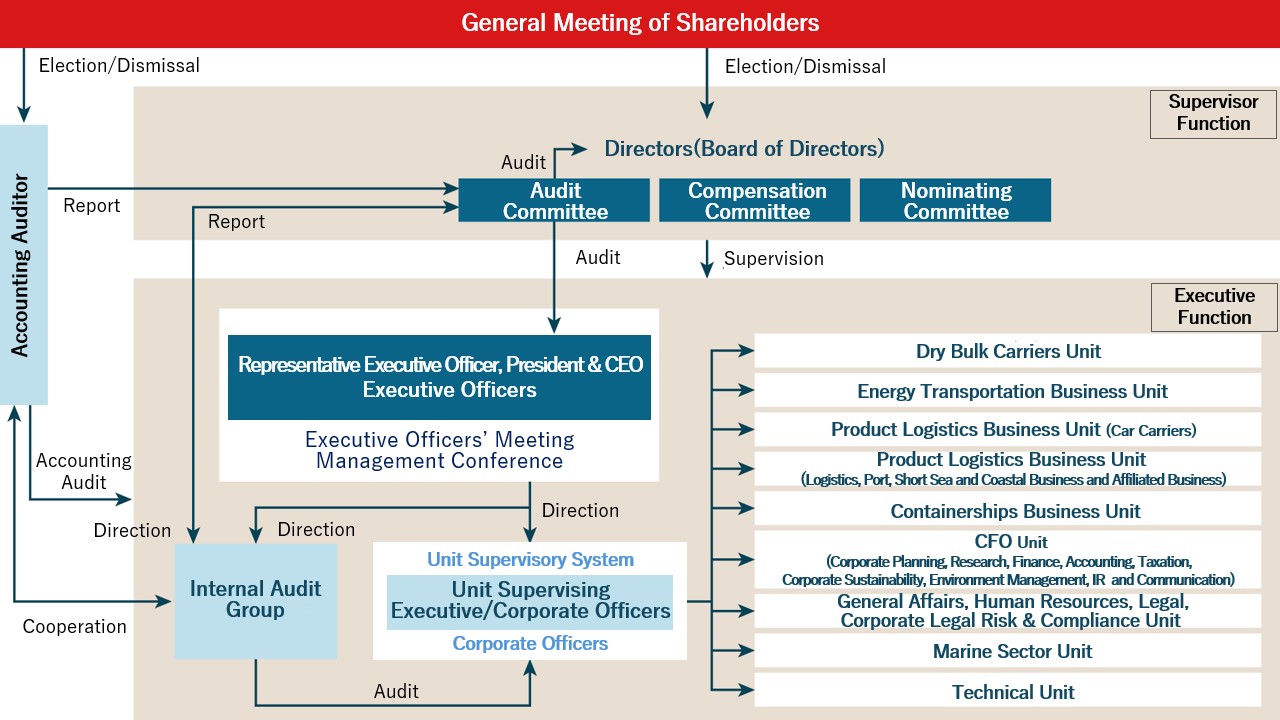

“K” LINE clearly separates the supervisory function from the executive function by adopting the governance structure of a “Company with a Nominating Committee, etc.”. This enhances the function of the Board of Directors and strengthens its overall corporate governance.

-

Corporate Governance Report

(754KB)

Corporate Governance Report

(754KB)

( January 23, 2026 )

“K” LINE clearly separates the supervisory function from the executive function by adopting the governance structure of a “Company with a Nominating Committee, etc.”. This enhances the function of the Board of Directors and strengthens its overall corporate governance.

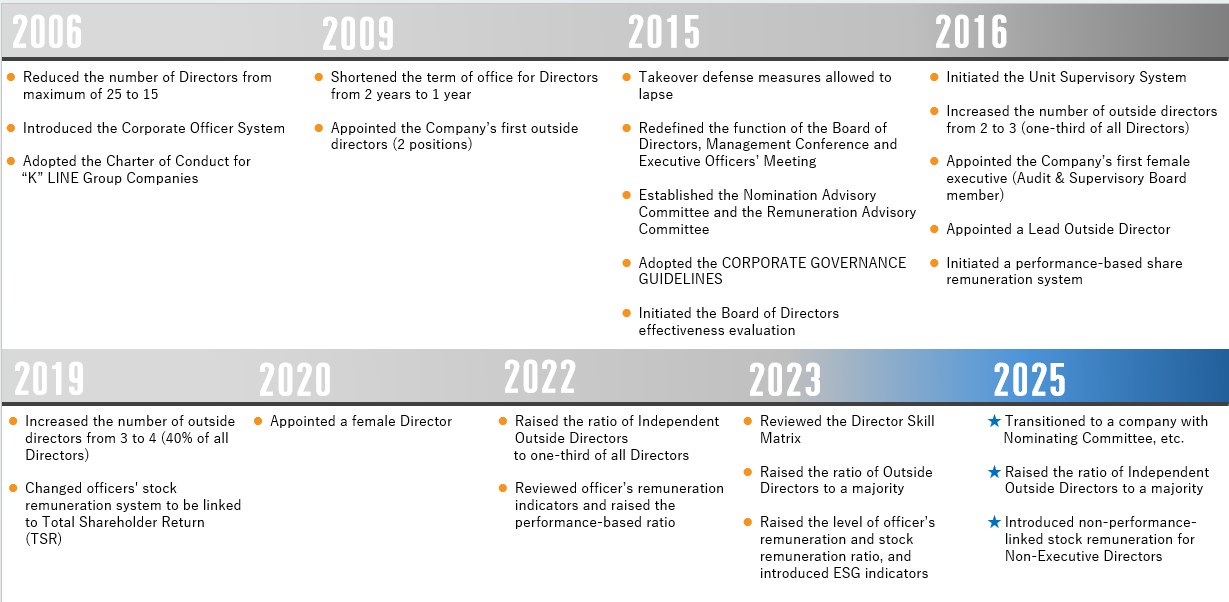

“K” LINE has promoted the active development of its governance structure by connecting the sustainable increase of corporate value with corporate governance reform, such as the appointment of several people as Outside Directors in 2009. the Company will continue to enhance internal discussions regarding the governance structure and steadily advance governance reform.

The Board of Directors is the body that discusses and determines basic management policies, corporate strategy and other important business matters, while also supervising the execution of business. The Board consists of 10 directors, 7 of whom are Outside Directors (including 6 Independent Outside Directors), and convenes at least once a month in principle.

|

Attended / Held |

|

|

Yukikazu Myochin (Chairperson of the Board) |

19/19 |

|

Takenori Igarashi |

1/1 |

|

Kunihiko Arai *2 |

19/19 |

|

Keiji Yamada |

19/19 |

|

Ryuhei Uchida |

19/19 |

|

Koji Kotaka |

19/19 |

|

Hiroyuki Maki |

19/19 |

|

Atsumi Harasawa*2 |

19/19 |

|

Shinsuke Kubo*2 |

19/19 |

*1 Directors who retired during fiscal 2024 are excluded.

*2 Attendance of Mr. Kunihiko Arai, Ms. Atsumi Harasawa and Mr. Shinsuke Kubo at Board meetings includes their attendance as Audit & Supervisory Board members.

- Long-Term Management Vision and Medium-Term Management Plan

- Capital Policy (Business Investment Plan/Shareholders Return Policy, etc.)

- Business Strategy (Businesses with a role driving growth/Expansion of new business domains, etc.)

- Functional strategy (Human resources/Organization, Digital Transformation, etc.)

- Corporate governance (Governance Structure, Board of Directors Effectiveness Evaluation/Officer’s Remuneration, Composition of the Board of Directors, etc.)

- Group governance

While aiming for sustainable growth and improvement in medium- to long-term corporate value, the Board of Directors has the duty and responsibility to properly supervise the management of the “K” LINE Group, where the mission is to support people’s affluent lives as vital infrastructure in the global community. The Company has identified the skills (knowledge, experience and abilities, etc.) required for the Board of Directors based on its materialities (a set of key issues) in its aim to enhance the functions of the Board of Directors with a thoughtful combination of these skills while considering diversity in the composition of the Board members.

Please see the skill matrix below for a list of the expertise and knowledge of each director.

|

Expertise and experience |

||||||||

|

Corporate Management & Strategy |

Legal & Risk Management |

Finance & Accounting |

Human Resources & Labor |

Safety & Quality |

Environment & Technology |

Global |

Sales & Marketing |

|

|

Yukikazu Myochin |

● |

● |

● |

● |

● |

● |

● |

|

|

Takenori Igarashi |

● |

● |

● |

● |

● |

● |

● |

|

|

Kunihiko Arai |

● |

● |

● |

● |

● |

|||

|

Keiji Yamada |

● |

● |

● |

● |

● |

|||

|

Ryuhei Uchida |

● |

● |

● |

|||||

|

Koji Kotaka |

● |

● |

● |

|||||

|

Hiroyuki Maki |

● |

● |

● |

● |

● |

● |

||

|

Takako Masai |

● |

● |

● |

● |

||||

|

Atsumi Harasawa |

● |

● |

● |

● |

||||

|

Shinsuke Kubo |

● |

● |

● |

● |

||||

In addition to satisfying the independence standards of the Tokyo Stock Exchange, “K” LINE has established its own more stringent criteria relating to independence for the nomination of Outside Directors.

The criteria are as follows.

As “K” LINE believes an effective corporate governance function is essential for sustainable growth and the enhancement of its corporate value over the medium to long term, the Board of Directors analyzes and evaluates the Board’s effectiveness each year, with the results disclosed in a timely and appropriate manner.

Please refer to the following for the latest results.

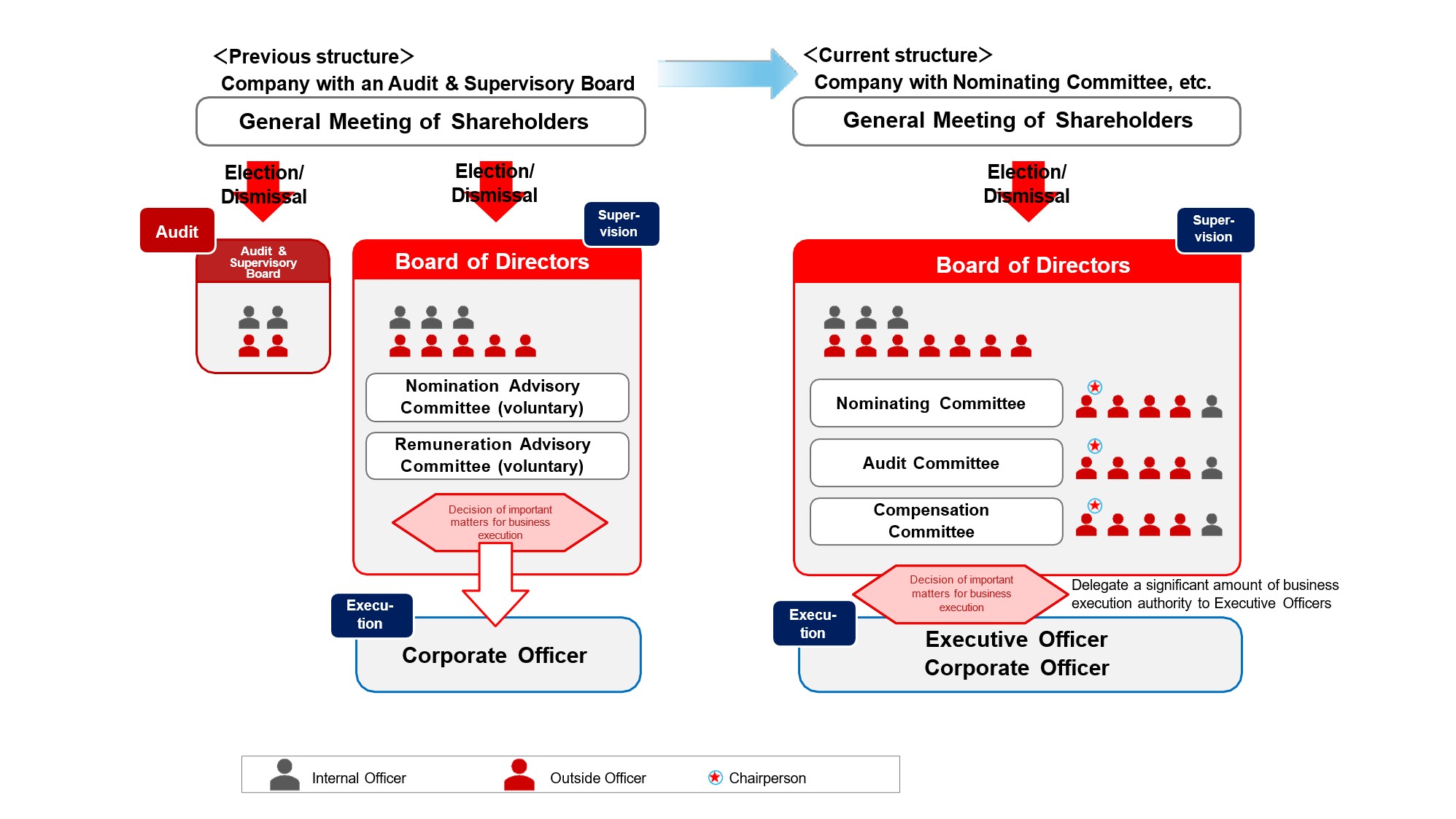

“K” LINE has adopted the governance structure of a "Company with a Nominating Committee, etc.". A company with a Nominating Committee, etc. has a governance structure in which the roles of Directors who supervise management are clearly separated from the roles of Executive Officers who execute business operations. The Board of Directors is responsible for determining management policy and otherwise performing supervision, while also delegating significant amount of business execution authority to Executive Officers, thereby enabling Executive Officers to make decisions more swiftly and manage operations more flexibly. Three statutory Committees (Nominating Committee, Audit Committee, and Compensation Committee) have been established within the Board of Directors, with Outside Directors constituting a majority of the membership in each committee.

|

Nominating Committee |

Audit Committee |

Compensation Committee |

|||

|

Members |

Keiji Yamada (Chairperson of the Nominating Committee, Outside Director) |

Members |

Koji Kotaka (Chairperson of the Audit Committee, Outside Director) |

Members |

Takako Masai (Chairperson of the Compensation Committee, Outside Director) |

|

Ryuhei Uchida (Outside Director) |

Atsumi Harasawa (Outside Director) |

Keiji Yamada (Outside Director) |

|||

|

Koji Kotaka (Outside Director) |

Hiroyuki Maki (Outside Director) |

Ryuhei Uchida (Outside Director) |

|||

|

Takako Masai (Outside Director) |

Shinsuke Kubo (Outside Director) |

Koji Kotaka (Outside Director) |

|||

|

Yukikazu Myochin (Director) |

Kunihiko Arai (Director, Standing Member of the Audit Committee) |

Yukikazu Myochin (Director) |

|||

The Nominating Committee is composed of a majority of Independent Outside Directors and is chaired by an Independent Outside Director. The Nominating Committee determines proposals related to the election and dismissal of Directors to be submitted to the General Meeting of Shareholders. Additionally, in response to inquiries from the Board of Directors, the Committee makes recommendations on the appointment or dismissal of Executive Officers, as well as the selection or removal of Representative Executive Officers and Executive Officers with specific titles.

Proposals related to the election and dismissal of Directors to be submitted to the General Meetings and the appointment and dismissal of Executive Officers by the Board of Directors, are deliberated by the Nominating Committee based on the "Criteria for the Election/Appointment and Dismissal of Directors and Executive Officers" below.

Article 14 of the CORPORATE GOVERNANCE GUIDELINES stipulates that “the Board of Directors shall have the Nominating Committee deliberate on the draft plan for his/her successor, which is prepared by the incumbent President & CEO each fiscal year. The Board of Directors receive a report of the results and confirm the reasonableness of the draft plan.”.

Through deliberation on succession plans for the next President & CEO by the Nominating Committee, which is primarily composed of Independent Outside Directors, we strive to enhance sustainable corporate value.

The Audit Committee is composed of a majority of Independent Outside Directors and is chaired by an Independent Outside Director. The Audit Committee audits the business execution by Directors and Executive Officers, prepares audit reports and makes decisions on proposals for the election, dismissal and non-reappointment of the accounting auditor. A dedicated department has also been established to support the Audit Committee's activities with staff members assigned to the role.

The Compensation Committee is composed of a majority of Independent Outside Directors and is chaired by an Independent Outside Director. The Compensation Committee formulates Policies (including systems) related to deciding the contents of remuneration for each individual Director and Executive Officer. Based on these policies, the Compensation Committee also makes decisions on the contents of remuneration for each individual Director and Executive Officer.

Our policy and procedures for determining remuneration are as follows:

Remuneration for Directors (excluding those concurrently serve as Executive Officers) consists of fixed remuneration (monetary) and fixed remuneration (stock). The remuneration for Executive Officers (including those concurrently serves as Director) consists of fixed remuneration (monetary), short-term performance-based remuneration (monetary) and medium- to long-term performance-based remuneration (stock). Regarding the stock remuneration system, points are awarded to Directors and Executive Officers each fiscal year. Upon their retirement, these points are then converted and provided as shares or the equivalent amount in cash equivalent to the market value through Board Benefit Trust (BBT).

For Directors, non-performance-based remuneration (stock) is provided based on a fixed amount in accordance with their duties and responsibilities, aiming to maintain and secure human resources capable of enhancing corporate governance commensurate as a global enterprise and sharing shareholder interests. For Executive Officers, medium- to long-term performance-based remuneration (stock) is provided to enhance the alignment between their compensation and share value and the awareness of mid-to-long-term performance improvement. Even if a Director or Executive Officer has been awarded points, their right to receive all or part of the share remuneration may be forfeited by resolution of the Compensation Committee if certain events stipulated in the Regulations for Delivery of Shares to Officers occur, such as dismissal by a shareholders' resolution, resignation, retirement due to certain misconduct during their tenure, or inappropriate actions that caused damage to the company during their tenure.

|

Remuneration type |

Directors (excluding those concurrently serve as Executive Officers) |

Executive Officers (including those concurrently serves as Director) |

Remuneration outline |

|

|

Fixed portion |

Fixed remuneration (monetary) |

〇 |

〇 |

Monthly remuneration set for each job title to ensure the execution of duties commensurate with responsibilities. |

|

Fixed remuneration (stock) |

〇 |

Fixed stock remuneration commensurate with responsibilities. |

||

|

Variable portion (Performance-based) |

Short-term performance-based remuneration (monetary) |

〇 |

Linked to the single fiscal year's consolidated performance and individual performance. A negative adjustment is applied in the event of a serious accident. |

|

|

Medium- to long-term performance-based remuneration (stock) |

〇 |

Linked to our mid- to long-term Total Shareholder Return(TSR), ROE and ESG indicators(Improving CO2 emissions efficiency). *TSR = Share price appreciation over a certain period + Dividend yield over a certain period (total dividends ÷ initial share price) *The weighting of the TSR, ROE, and ESG indicators is 90:5:5. |

||

For information on remuneration amounts for each fiscal year, please refer to Governance Data.

The President & CEO, other Executive Officers, Senior Managing Corporate Officers and above, Unit Supervising Corporate Officers and the Corporate Officers in charge of Legal, Corporate Legal Risk & Compliance, Corporate Planning, Finance and Accounting as well as individuals selected by the Audit Committee, attend the Management Conference. This conference is designed to support the decision-making of the President & CEO or their alternate through open discussion, and it’s generally held weekly.

Executive Officers, Corporate Officers, and individuals selected by the Audit Committee and the President & CEO comprise this meeting, which serves as forum for reporting and discussing business execution, including monthly performance of the business execution organizations, as well as the approved matters, and it’s generally held once a month.

Meetings of the Investment Committee, consisting of Corporate Officers in charge of corporate planning and finance, and Executive/Corporate Officers and General Managers appointed by the President & CEO, are generally held twice a month. This committee deliberates on basic plans and important initiatives for maximizing investment returns, considering the Company’s investment capacity. The committee also monitors the effectiveness of past investments and considers whether to terminate or cease them.

From April 2016, “K” LINE introduced the Unit Supervisory System and established unit supervising Executive/Corporate Officers to further improve the efficiency of and reinforce the system for business execution.

Under the Unit Supervisory System, the President & CEO oversees eight Unit Supervising Executive/Corporate Officers, each responsible for multiple business and administrative departments. Under each Unit Supervising Executive/Corporate Officer are the responsible Corporate Officers in charge of individual departments. Each unit is as follows.

• Dry Bulk Carriers Unit

• Energy Transportation Business Unit

• Product Logistics Business Unit (Car Carriers)

• Product Logistics Business Unit (Logistics, Port, Short Sea and Coastal Business and Affiliated Business)

• Containerships Business Unit

• CFO Unit (Corporate Planning, Research, Finance, Accounting, Corporate Sustainability, Environment Management, IR and Communication)

• General Affairs, Human Resources, Legal, Corporate Legal Risk & Compliance Unit

• Marine Sector Unit

• Technical Unit

“K” LINE has established the following procedures with respect to related party transactions and recognizes that these procedures enable oversight.

(1) The Regulations on Decision-Making Standards stipulate that the Company is to refer matters to be addressed by and seek prior approval from the Board of Directors with respect to certain matters irrespective of monetary amount, such as transactions with major shareholders whose holdings account for more than 10% of the Company’s voting rights or transactions between the Company and its Directors and/or Executive Officers and transactions conducted by a directors and/or Executive Officers with the Company for a third party, transactions involving a conflict of interest and debt guarantees of directors and/or Executive Officers made by the Company. The Regulations on Decision-Making Standards also stipulate that key developments must be reported to the Board of Directors subsequent to having carried out a transaction. As such, the Board of Directors supervises appropriateness of transactions.

(2) The Company shall treat all of its shareholders impartially and accordingly does not make special considerations for specific shareholders.

(3) The Company shall determine the presence or absence of related-party transactions upon submission of confirmation documents for all of the Company’s officers each fiscal term and shall furthermore verify transaction details if related-party transactions have taken place.

The Board of Directors carefully and comprehensively examines cross-shareholdings of listed shares from its independent and objective standpoint at least once per year to verify the purpose, the necessity in business activities, the mid- to long-term economic rationale based on the capital cost, and appropriateness of individual holdings. In examining economic rationale, The Board will consider reducing shares that are deemed not to be reasonable to continue holding. The Company has been reducing strategic shareholdings, and as of March 31, 2025, the number of strategic shareholdings of listed shares was three.

Specified investment shares

| Issues | Fiscal 2024 | Fiscal 2023 | Purpose of holding, quantitative effect of holding, and reason for increase in number of shares | Holds “K” LINE shares |

| Shares | Shares | |||

| Balance sheet amount (millions of yen) |

Balance sheet amount (millions of yen) |

|||

| JFE Holdings, Inc. |

5,062,170 | 5,062,170 | As JFE Holdings is a major customer in the Dry Bulk segment, “K” LINE continues to hold shares in JFE Holdings to sustain and enhance a longterm positive business relationship with this company. | No |

| 9,294 | 12,857 | |||

| Kawasaki Heavy Industries, Ltd. (KHI) | 1,001,699 | 1,001,699 | As KHI is a collaborator in the field of advanced technologies and in “K” LINE’s initiatives at decarbonization and efforts to improve safety and quality, such as through field experiments with liquefied hydrogen carriers, “K” LINE continues to hold KHI shares to sustain and enhance a long-term positive business relationship with this company. | Yes |

| 8,955 | 5,105 | |||

| Kamigumi Co., Ltd. |

118,404 | 118,404 | As Kamigumi Co., Ltd. is a customer and collaborator in the Product Logistics segment through the co-establishment of a holding company and other factors, “K” LINE continues to hold Kamigumi shares to sustain and enhance a long-term positive business relationship with this company. | Yes |

| 415 | 397 |

Notes

1. If the holder of “K” LINE shares is a holding company, the number of shares held by major subsidiaries (number of shares actually held) is indicated.

2. As it is difficult to quantify the effect of shareholdings, the method used to verify the rationale behind said holdings is described. The “K” LINE Board of Directors verifies the appropriateness of individual holdings on a fiscal year-end basis.

When exercising the voting rights as to the Cross-Shareholdings, “K” LINE shall fully examine whether or not the relevant propositions would contribute to the enhancement of its corporate value, hold dialogues with issuing entities as needed, and shall determine whether it would vote for or against the said propositions.

“K” LINE is committed to establishing systems to ensure that the execution of business and duties by Executive Officers, Corporate Officers and our employees complies with laws, regulations and the Articles of Incorporation, and other systems required by law to ensure the appropriateness of “K” LINE Group’s business operations. Specifically, the Board of Directors is responsible for establishing, evaluating the effectiveness of, and ensuring the functionality of the internal control system. In addition, through monitoring and verifying the internal control system, the Internal Audit Group supports the Board of Directors, Executive Officers and Corpoarte Officers in fulfilling its responsibilities for the development, maintenance, and enhancement of the internal control system.

To ensure proper business operations of entire “K” LINE Group companies, we have established the Charter of Conduct for “K” LINE Group Companies as a code of conduct applicable to entire “K” LINE Group companies. Based on this Charter, each Group company has established its own rules and regulations. We have also established Affiliate Business Management Rules and require our group companies to seek approval for, consult on or report on certain important matters.

Ernst & Young ShinNihon LLC

|

Item |

Amount |

|

①Amount of remuneration to be paid to the accounting auditor by the Company |

¥109 million |

|

②Total amount of money and other financial benefits to be paid to the accounting auditor by the Company and its subsidiaries |

¥172 million |

Note: The audit contract between the Company and the accounting auditor does not classify the remuneration amounts separately for audits pursuant to the Companies Act and for audits pursuant to the Financial Instruments and Exchange Act, partially given the impracticality of deriving such classifications. Therefore, the amount listed in (1) is not classified in this way. Of the Company’s principal subsidiaries, etc., accounting auditors other than the accounting auditor of the Company audit documents relating to accounts of “K” LINE BULK SHIPPING (UK) LIMITED, “K” LINE LNG SHIPPING (UK) LIMITED, “K” LINE PTE LTD., and OCEAN NETWORK EXPRESS PTE. LTD.

The Audit & Supervisory Board obtained necessary materials and received reports from directors, the related internal departments and the accounting auditor, and after conducting the necessary verification and deliberations on whether the content of audit plans conducted by the accounting auditor, the execution status of the accounting auditor’s duty, and the basis for calculation of estimates for their remuneration, etc., are appropriate, the Board gave the consent provided for in Article 399, Paragraph 1, of the Companies Act.

At the Extraordinary General Meeting of Shareholders held on March 28, 2025, it was resolved to transition the Company’s corporate governance structure to a company with Nominating Committee, etc. Accordingly, the Audit Committee has taken over the duties previously performed by the Audit & Supervisory Board.

“K” LINE paid to the Accounting Auditor a consideration for the preparation of comfort letters in issuing corporate bonds.

If deemed necessary by the Audit Committee in cases such as where an accounting auditor has difficulty in the execution of their duties, the Audit Committee shall determine the content of a proposition regarding the dismissal or non-reappointment of the accounting auditor to be submitted to the General Meeting of Shareholders. If circumstances involving an accounting auditor are deemed to fall under any of the items of Article 340, Paragraph 1, of the Companies Act, the accounting auditor shall be dismissed subject to unanimous approval by the Audit Committee. In any such case, Members of the Audit Committee appointed by the Audit Committee shall report on the dismissal of the Accounting Auditor and the grounds for dismissal at the first General Meeting of Shareholders to be convened after the dismissal.

The internal audit of “K” LINE is carried out by the Internal Audit Group, which has eleven full-time employees. They audit the execution of business and duties for “K” LINE and the “K” LINE Group companies, in terms of internal control, such as enhancing the effectiveness and efficiency of business operations, improving the trustworthiness of financial information, and ensuring compliance. Members of the Audit Committee, the Audit Committee and the Internal Audit Group regularly and irregularly exchange information regarding details of audits and auditing firms that act as accounting auditors. They maintain close contact and exchange opinions regarding the results of the audit, the status of internal control as understood by the auditing firm, and risk evaluations. The Internal Audit Group periodically provides audit reports to the President & CEO, Members of the Audit Committee and the Audit Committee.

“K” LINE transitioned from a "Company with an Audit & Supervisory Board" to a "Company with a Nominating Committee, etc." on March 28, 2025.

|

Field |

Item |

Breakdown |

Unit |

Fiscal year |

||

|

2022 |

2023 |

2024 |

||||

|

Governance |

Board of Directors |

Number of directors |

Persons |

9 |

9 |

10 |

|

Men |

Persons |

8 |

8 |

8 |

||

|

Women |

Persons |

1 |

1 |

2 |

||

|

Ratio of women |

% |

11 |

11 |

20 |

||

|

Number of outside directors |

Persons |

4 |

5 |

7 |

||

|

Ratio of outside directors |

% |

44 |

56 |

70 |

||

|

Average age of directors |

Years |

62.0 |

61.2 |

60.0 |

||

|

Age of youngest director |

Years |

45 |

43 |

44 |

||

|

Age of oldest director |

Years |

74 |

75 |

70 |

||

|

Number of meetings held |

Times |

19 |

19 |

19 |

||

|

Average attendance ratio |

% |

99 |

100 |

100 |

||

|

Nominating Committee (The data for FY2022 and FY2023 are from the time of the Nomination Advisory Committee.) |

Number of members |

Persons |

4 |

5 |

5 |

|

|

Number of outside members |

Persons |

3 |

4 |

4 |

||

|

Ratio of outside members |

% |

75 |

80 |

80 |

||

|

Number of meetings held |

Times |

14 |

9 |

10(*1) |

||

|

Audit Committee (The data for FY2022 and FY2023 are from the time of the Company with an Audit & Supervisory Board.) |

Number of members |

Persons |

4 |

4 |

5 |

|

|

Number of outside members |

Persons |

2 |

2 |

4 |

||

|

Ratio of outside members |

% |

50 |

50 |

80 |

||

|

Number of meetings held |

Times |

15 |

14 |

15(*1) |

||

|

Compensation Committee (The data for FY2022 and FY2023 are from the time of the Remuneration Advisory Committee.) |

Number of members |

Persons |

4 |

5 |

5 |

|

|

Number of outside members |

Persons |

3 |

4 |

4 |

||

|

Ratio of outside members |

% |

75 |

80 |

80 |

||

|

Number of meetings held |

Times |

9 |

3 |

7(*1) |

||

|

Remuneration |

Total remuneration paid to directors (number of payees*2) |

¥ million (persons) |

906(10) |

732(11) |

634(11) |

|

|

Total remuneration paid to Audit & Supervisory Board members (number of payees*2) |

¥ million (persons) |

80(4) |

80(5) |

80(4) |

||

*1 The number of meetings includes one meeting held after the transition to a Company with a Nominating Committee, etc.

*2 Total remuneration paid (number of payees) includes directors and Audit & Supervisory Board members who have resigned during the fiscal year (at the general meeting of shareholders).

|

Title |

Name |

Gender |

Independence |

Tenure (years) |

Board meeting attendance rate (FY2024) |

Executive officer |

Nominating Committee member |

Audit Committee member |

Compensation Committee member |

Important concurrent positions |

|

Director, Chairperson of the Board |

Yukikazu Myochin |

Male |

No |

9 |

100% |

○ |

○ |

Yes |

||

|

Director, Representative Executive Officer, President & CEO |

Takenori Igarashi |

Male |

No |

0.25 |

100% |

○ |

||||

|

Director |

Kunihiko Arai |

Male |

No |

0.25 |

100% |

○ (Standing Member) |

||||

|

Independent & Lead Outside Director |

Keiji Yamada |

Male |

Yes |

6 |

100% |

○ (Chairperson) |

○ |

Yes |

||

|

Outside Director |

Ryuhei Uchida |

Male |

No |

6 |

100% |

○ |

○ |

Yes |

||

|

Independent & Outside Director |

Koji Kotaka |

Male |

Yes |

2 |

100% |

○ |

○ (Chairperson) |

○ |

Yes |

|

|

Independent & Outside Director |

Hiroyuki Maki |

Male |

Yes |

2 |

100% |

○ |

Yes |

|||

|

Independent & Outside Director |

Takako Masai |

Female |

Yes |

1 |

100% |

○ |

○ (Chairperson) |

Yes |

||

|

Independent & Outside Director |

Atsumi Harasawa |

Female |

Yes |

0.25 |

100% |

○ |

Yes |

|||

|

Independent & Outside Director |

Shinsuke Kubo |

Male |

Yes |

0.25 |

100% |

○ |

Yes |

On March 28, 2025, Kawasaki Kisen Kaisha, Ltd. (“K” LINE) held an Extraordinary General Meeting of Shareholders and shifted its corporate governance structure from a Company with an Audit and Supervisory Board to a Company with a Nominating Committee, etc. To facilitate an exchange of views and sharing of information on the situation following this transition and the outlook going forward, a small discussion meeting was convened with participation from the (non-executive) chairperson of “K” LINE’s Board of Directors, several of its outside directors, as well as some institutional investors and analysts.